MASTER YOUR CREDIT

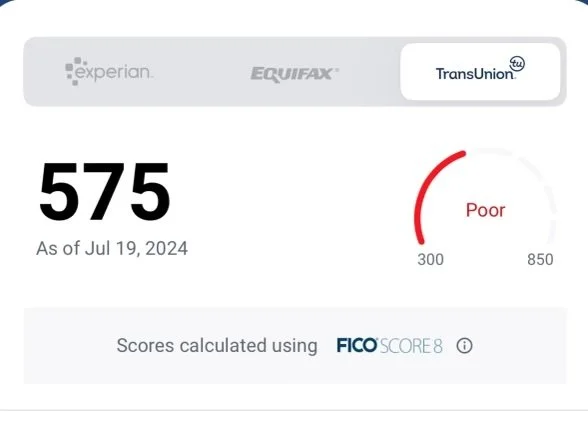

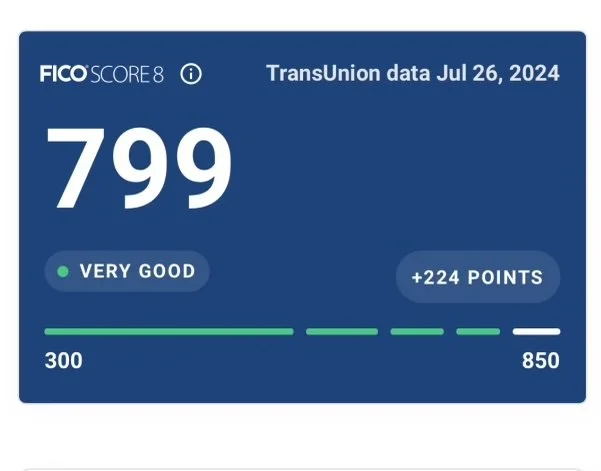

Are you tired of being held back by a poor credit score? Imagine unlocking the financial freedom you've always dreamed of! With over 5 years of experience in credit repair, I have successfully helped more than 300 people transform their credit profiles. Unlike many services that charge thousands of dollars and takes months, even years to see significant results, my affordable credit repair option is just a one time fee of $1500 $900. Ready to get started? Book a consulting call today or fill out the form below and take the first step towards a brighter financial future. No more spending thousands for the results you deserve!

FAQs

WHAT IS CREDIT REPAIR?

Credit repair involves identifying and addressing errors or negative items on your credit report to improve your credit score.

HOW LONG DOES CREDIT REPAIR TAKE?

The duration varies, it generally takes three to six months to see significant improvements with traditional credit repair methods, depending on the complexity of your credit we’re usually able to get you amazing results with transunion within 2 weeks.

CAN I REPAIR MY CREDIT MYSELF, OR DO I NEED PROFESSIONAL HELP?

You can repair your credit yourself by disputing errors with the credit bureaus, but professional help can streamline the process and provide expert guidance. Free resources are available in our discord server, heres an invite link https://discord.gg/wYFC7CyeFt

Inaccurate information, outdated accounts, duplicate entries, collections, medical bills, student loans and unverifiable debts can often be removed from your credit report.

HOW OFTEN SHOULD I CHECK MY CREDIT REPORT?

It's recommended to check your credit report at least once a month from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

WILL CREDIT REPAIR AFFECT MY ABILITY TO GET NEW CREDIT?

Effective credit repair can improve your credit score, which may enhance your ability to get new credit. However, applying for new credit during the repair process can temporarily lower your score.

WHAT IS A CREDIT UTILIZATION RATIO, AND HOW DOES IT AFFECT MY CREDIT SCORE?

The credit utilization ratio is the amount of credit you're using compared to your total credit limit. A lower ratio positively affects your credit score, ideally keeping it below 30%.

HOW DO I GET A COPY OF MY CREDIT REPORT?

You can obtain a copy of your credit report annually from each of the three major credit bureaus through https://myfreescorenow.com/enroll/?AID=AtaraxiaConsultingLLC&PID=65044