Mind Map

“Some people want it to happen, some wish it would happen, others make it happen.”

CREDIT

Want to achieve financial freedom but don’t know where to start? You’re on the right page! I will give you the blueprint on what I think is the best tools and path to achieve financial freedom. Now if you live in the US you might be scared of this topic but we must start here, Credit.

Do you know your credit score and what exactly is on your credit report across all 3 bureaus ? if not click here to find out.

How are credit scores calculated?

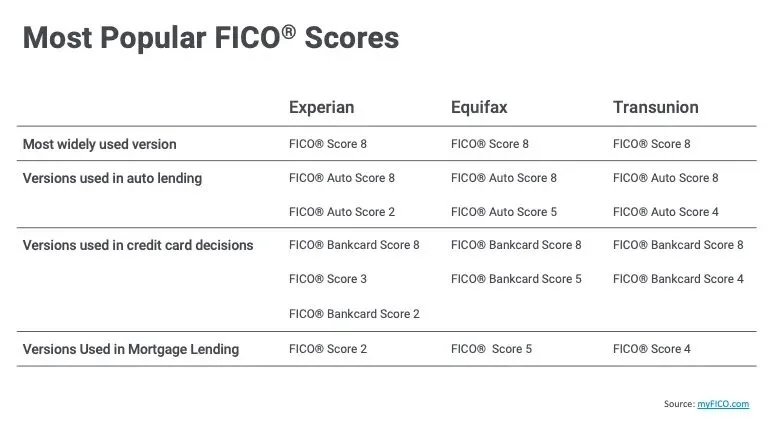

Every score is based on information gathered by the major credit bureaus: Experian, Equifax, and TransUnion. These credit reporting agencies gather data from credit card companies, financial institutions, and lenders to create a report.

Credit scoring models analyze the credit report information and assign value to each factor. Depending on the model, some factors will be highly influential while others only account for a small percentage of your overall score. As a result, different scoring models will produce different credit scores, even if they reference the same credit report.

Difference between credit scores and credit reports

Your credit score is not the same as your credit report. Credit scoring companies use the information on your credit report to determine your credit score.

A credit report documents your credit and payment history. It’s the information contained within your credit report that determines your creditworthiness and, consequently, your score.

It’s important to regularly check your own credit report to spot items that could inflict long-term damage on your credit. Lenders look at one of three credit reports, so make sure the information is correct and that it matches across agencies.

Factors That Make Up Your Credit Score

Payment history: Paying on time improves credit scores, while too many late payments are seen as a higher risk.

Debt total amount: Any large debt amounts are considered higher risk, be it mortgage, auto loan, student loan, personal loan, or credit card debt.

Length of credit history: The longer your history of accounts in good standing, the better your credit score.

New credit accounts: Having too many new accounts may be seen as a sign of credit risk.

Different types of credit: Having different accounts, such as a credit card and a loan, is known as having a “credit mix” and tends to help your credit score.

Credit utilization ratio: Using more than 30% of your available credit lines makes you seem unreliable. As a result, any utilization that exceeds 30% will hurt your credit score.

What Can Lower Your Credit Score?

Credit scores decrease through a combination of a person’s own actions, external factors like identity theft and fraud, or any combination of these.

Several factors can lower your credit score. Here are some common ones:

Late or Missed Payments:

Payment history is a significant factor in your credit score. Late or missed payments on credit cards, loans, or other bills can significantly impact your score.

High Credit Utilization Ratio:

Using a large percentage of your available credit can lower your score. It's generally recommended to keep your credit utilization below 30%.

Frequent Hard Inquiries:

Multiple hard inquiries, which occur when you apply for new credit, can lower your score. These are different from soft inquiries, which do not affect your score.

Defaulting on Loans:

Failing to pay back loans, such as personal loans, mortgages, or auto loans, can significantly damage your credit score.

Bankruptcy or Foreclosure:

Both of these events have a severe negative impact on your credit score and can remain on your credit report for up to 10 years.

Charge-Offs:

If a creditor decides you will not pay back a debt and writes it off as a loss, this charge-off will negatively affect your score.

Collections Accounts:

Accounts that are sent to collections agencies indicate that you have failed to pay a debt, which harms your credit score.

High Levels of Debt:

Having a large amount of debt relative to your income can lower your score, as it may indicate financial instability.

Short Credit History:

A short credit history or having new credit accounts can lower your score since the length of your credit history is a factor in your credit score.

Closing Credit Accounts:

Closing old or unused credit accounts can lower your credit score by reducing your available credit and shortening your credit history.

Errors on Your Credit Report:

Incorrect information, such as wrongly reported late payments or accounts that don’t belong to you, can negatively affect your score.

Not Having a Mix of Credit Types:

A diverse credit mix (e.g., credit cards, installment loans, mortgages) can positively impact your score. Relying solely on one type of credit can have a lesser positive effect.

Monitoring your credit report regularly and addressing any issues promptly can help you maintain a healthy credit score.

Some benefits to having good credit include:

Lower Interest Rates: Enjoy reduced rates on loans and credit cards.

Easier Loan Approvals: Increase your chances of getting approved for loans and mortgages.

Better Insurance Rates: Qualify for lower premiums on auto and home insurance.

Higher Credit Limits: Access larger lines of credit and higher borrowing limits.

Once you get to above 680 credit with no negative items on your credit you then want to get some high limit interest free cards, you can do so by going through my funding company Next Level Funding, I recommend having an LLC at least 24hrs old so we can get you minimum $80,000 in funding.

So you have 700+ Credit and almost $100,000 if not more available in credit, now what?

This is where the pressure comes in, fight the temptation of materialism, its time to leverage your credit and let your money work for you. Find a few passive income streams and a few non passive income streams. If you need help finding something for your specific needs, book a call and we can surely figure something out.

Here’s a few examples of what you can do:

Invest in Real Estate:

Use your credit to invest in rental properties. Rental income can provide a steady cash flow. Consider properties in high-demand areas or those that require minimal repairs.

Start a Business:

Use your credit to fund a business venture. Choose a business with a strong cash flow potential, such as e-commerce, consulting, or a franchise. Create a solid business plan to ensure success. Personally I’d recommend the e-commerce route, we manage over 100 stores at Next Level Commerce , affordable stores with great returns. Our average client makes $6,000 a month PROFIT!

Improve and Resell:

Buy items with your credit that you can improve and resell at a higher price, such as flipping houses, cars, or high-value collectibles.

Education and Skill Enhancement:

Invest in courses or certifications that enhance your skills, leading to higher-paying job opportunities or the ability to start a profitable side business.